Understanding mining pools is crucial if you want to maximize your cryptocurrency mining efficiency. When you join a pool, you combine your mining power with others, boosting your chances of earning rewards. This collaboration minimizes the risks of solo mining and offers more consistent payouts. You'll typically contribute your hash rate, and rewards are shared according to your input. However, be mindful of pool fees and operator reputation, as these can impact your profits. Each decision plays a key role in your success, and there's plenty more to explore on how to choose the best mining strategy for you.

Key Takeaways

- Mining pools combine the computational power of multiple miners, increasing the chances of successfully mining blocks and earning rewards.

- Participants in mining pools benefit from more stable income streams compared to solo mining, thanks to shared rewards based on contributions.

- Joining a mining pool requires account creation and submission of wallet information, with various payout schemes available for reward collection.

- Operator reliability and reputation are crucial, as they ensure fair distribution of tasks and rewards while maintaining security against potential risks.

- Larger mining pools can centralize hashing power, impacting network decentralization, so miners must weigh the pros and cons when selecting a pool.

Mining Pool Fundamentals

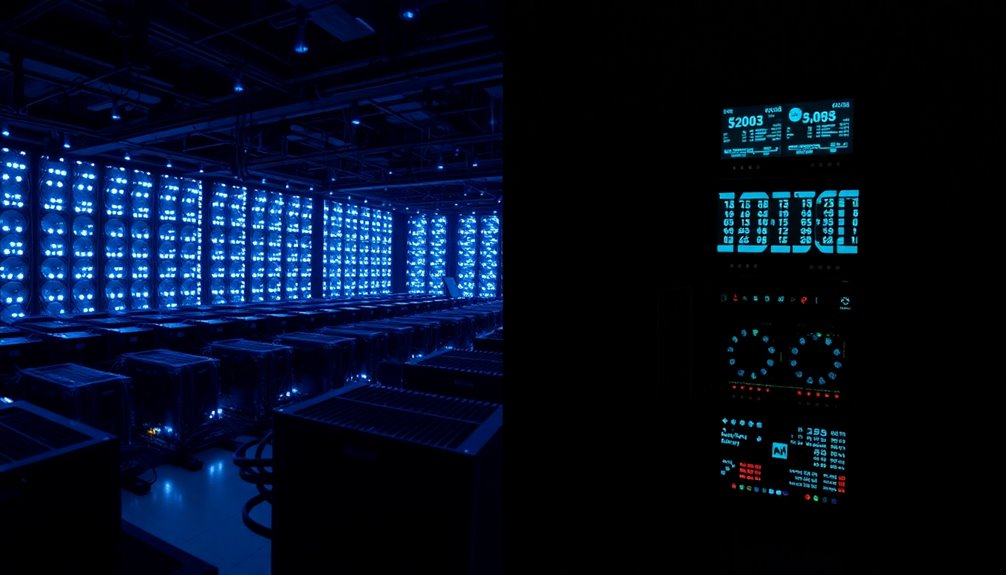

Mining pools serve as a lifeline for many cryptocurrency miners seeking to optimize their efforts. By joining a mining pool, you combine your computational power with others, significantly increasing the chances of successfully mining a block and earning rewards.

Instead of facing the risks and variances of solo mining, you benefit from a more stable income stream. Each miner's contribution is measured in shares, and rewards are distributed through various payout schemes like Pay Per Share (PPS) or Pay Per Last N Shares (PPLNS).

Transparency is crucial in these operations, as it builds trust among participants. Knowing that pool operators manage rewards fairly and securely helps you feel more confident in your mining endeavors.

Mining Pool Participation Overview

Joining a mining pool offers you a practical way to enhance your mining experience. By joining mining pools, individual miners can combine their processing power, increasing the chances of successfully mining blocks and earning rewards.

You'll typically connect your mining machines to a pool's server, where the software handles task distribution and reward allocation. Different payout schemes, like Pay Per Share (PPS) or Pay Per Last N Shares (PPLNS), allow you to choose how you receive your earnings based on your contributions.

When you decide to join a pool, remember to create an account and provide your wallet information. Don't overlook the importance of the pool operators' reputation, as it can significantly affect your trust and potential earnings.

Pooling Computational Resources Efficiently

By collaborating in a mining pool, you significantly enhance your chances of success while reducing the financial risks associated with solo mining.

Mining pools allow you and other miners to combine your computational resources, which boosts your collective hashing power. This collaboration leads to a higher probability of successfully mining blocks and receiving rewards.

The rewards from block mining are distributed based on each member's contribution, using payout structures like Pay Per Share or Pay Per Last N Shares. Major pools, like Foundry and AntPool, control over 50% of the hashing power, highlighting the importance of teamwork.

Additionally, pooling resources grants you access to shared technical support and community knowledge, making your mining efforts more efficient and cost-effective.

Pros and Cons of Pools

While pooling resources can significantly increase your chances of earning consistent rewards, it comes with both advantages and disadvantages.

Mining pools allow you to combine your computing power with others, leading to more predictable income streams, especially if you have limited resources. However, by joining a pool, you share the rewards based on your contributed hashrate, which can decrease your individual earnings compared to solo mining.

Additionally, large pools can centralize mining power, raising concerns about the overall decentralization of the cryptocurrency network.

Don't forget about pool fees, typically ranging from 1% to 3%, which can further cut into your profits.

Pool Size Versus Individual Mining

When considering whether to mine solo or join a pool, it's essential to weigh the advantages of each approach.

Mining pools aggregate the hashing power of many individual miners, significantly boosting your chances of successfully mining a block. In large pools like Foundry and AntPool, which control over 50% of Bitcoin's total hashing power, participating can lead to more predictable block rewards.

As a pool participant, you'll earn earnings based on your contributed hash rate, reducing the volatility typically faced in solo mining. While individual miners may struggle with long block production times, pooling efforts enable quicker and more consistent results.

For smaller miners, joining a pool levels the playing field, allowing you to compete without extensive resources.

Operator Reliability Issues

Choosing a mining pool isn't just about the potential rewards; operator reliability plays a crucial role in your success. You need to depend on pool operators to manage the distribution of tasks and rewards accurately.

A poorly maintained cloud infrastructure can expose you to security risks, so researching the trustworthiness of pool operators is essential. Historical incidents of mismanaged funds underscore the importance of selecting reputable pools.

Regular security audits are vital to mitigate risks like DDOS attacks that can disrupt operations. Also, be cautious about centralization risks; relying on a dominant operator can harm the overall health of the mining ecosystem.

Ensuring operator reliability is key to protecting your investments and maximizing your returns in mining pools.

Emergence of Decentralized Pools

As concerns about centralization in mining pools grow, decentralized mining solutions are emerging as a viable alternative.

These decentralized pools distribute mining power among numerous participants, ensuring no single entity dominates the hash rate. When miners join these pools, they often benefit from non-custodial models that let them maintain control over their funds, reducing risks of theft or mismanagement.

Innovations like the Stratum v2 protocol enhance these pools, giving miners more control over transaction selection and fostering a democratic mining process. Notable initiatives, such as OCEAN, are gaining traction by promoting transparency and community engagement, ultimately leading to equitable distribution of rewards among miners.

This shift aims to secure blockchain networks while empowering individual participants.

Select Reputable Pool Operators

Selecting reputable pool operators is crucial to maximizing your mining experience and ensuring your investments are secure.

Start by researching each mining pool's reputation through reviews and feedback on platforms like Trustpilot and Reddit. This helps you identify reliable and transparent options.

Next, evaluate the pool's fee structure, as most pools charge between 1-3% of rewards, which can significantly affect your profitability.

Review the payout schemes offered, like Pay Per Share (PPS) or Pay Per Last N Shares (PPLNS), to find one that matches your earning expectations.

Ensure the pool has a robust security infrastructure to protect against cyber threats.

Finally, look for pools that provide real-time statistics and performance tracking to analyze your contributions and earnings effectively.

Frequently Asked Questions

How Do Mining Pools Work?

Mining pools work by letting you connect your mining hardware to a shared server, where you and other miners combine your processing power.

This collaboration boosts your chances of successfully mining a block. When a block is mined, the rewards get distributed based on each miner's contributions, which are tracked via shares.

Different payout structures, like PPS or PPLNS, determine how you'll earn, while pool operators usually take a small fee for their services.

Which Mining Pool Is Most Profitable?

When deciding which mining pool is most profitable for you, consider factors like payout structure, fees, and overall transparency.

Pools like Foundry and AntPool dominate the market, but their size can impact your earnings.

Look for pools with low fees and consistent payouts to maximize your rewards.

Researching and comparing options based on their hashing power, payout methods, and geographical factors will help you make an informed choice that boosts your profitability.

How Do Mining Pools Prevent Cheating?

Mining pools balance trust and technology to prevent cheating. While some might attempt to game the system, pools implement share systems that ensure only valid work gets rewarded.

They use algorithms to filter out fraudulent submissions, maintaining integrity in payouts. Mechanisms like Pay Per Share tie rewards directly to your contributions, discouraging deception.

Regular audits and transparency reinforce this trust, making it harder for dishonest practices to thrive amidst the collaborative environment.

How Long Does It Take to Mine 1 Bitcoin?

It usually takes about 10 minutes to mine one Bitcoin, but that can vary a lot.

Your mining hardware, energy costs, and overall network conditions play a big role in the actual time.

If the network's hash rate is high or the mining difficulty increases, you could find it takes longer than expected.

Conclusion

In the world of cryptocurrency, joining a mining pool can feel like teaming up for a relay race—you're combining strengths to reach the finish line faster. By understanding the fundamentals, weighing the pros and cons, and selecting reputable operators, you can enhance your mining experience. While individual efforts can yield rewards, pooling resources often leads to greater efficiency and success. So, dive into the mining pool landscape, and you might just strike gold together!